Zenyo Payroll transforms the payroll process into an efficient, automated, and affordable solution for businesses seeking to bridge the gap between payroll and tax management. Designed with user-friendliness in mind, Zenyo ensures employees are paid on time, every time. The platform allows for seamless payroll runs and generates detailed payslips that break down taxes, allowances, and deductions with clarity. Forget the risks and tedious tasks associated with traditional payroll systems; Zenyo takes care of everything, including filing taxes through comprehensive reports. By offering a simplified approach to managing employees’ finances, Zenyo empowers businesses to focus on growth rather than administrative burdens. It stands as a supportive partner, providing tools that streamline operations and eliminate complexities, making it an ideal solution for any organization aiming to enhance efficiency and reliability in their payroll processes.

Read morePricing

SW Score Breakdown

Platforms Supported

Organization Types Supported

API Support

Modes of Support

Unique Features

401(k) Tracking

Helps to track and manage matters concerning 401(k) that is a retirement savings plan sponsored by an employer.Standard Features

Tax Filing

Allows the filing of payroll tax forms for federal, state, and local taxes.Deductions Management

Helps optimizing deductions workflow and assist in calculating various deductions or additions like ESI, PF, integrating leave, performanceCompensation Management

Manages employee compensation related data in an organized and automated mannerPEO Services

Professional Employer Organizations (PEOs) offer small and medium-sized businesses affordable HR services and benefits by serving as co-employers and managing compliance, eliminating the need for an in-house HR department.EOR Services

Facilitates the management of employment-related responsibilities, compliance, and HR functions associated with Employer of Record (EOR) servicesWage Garnishment

Helps in deducting the amount from an employee's monetary compensation including salary as per a court order to pay off debtFree Trial

Not available

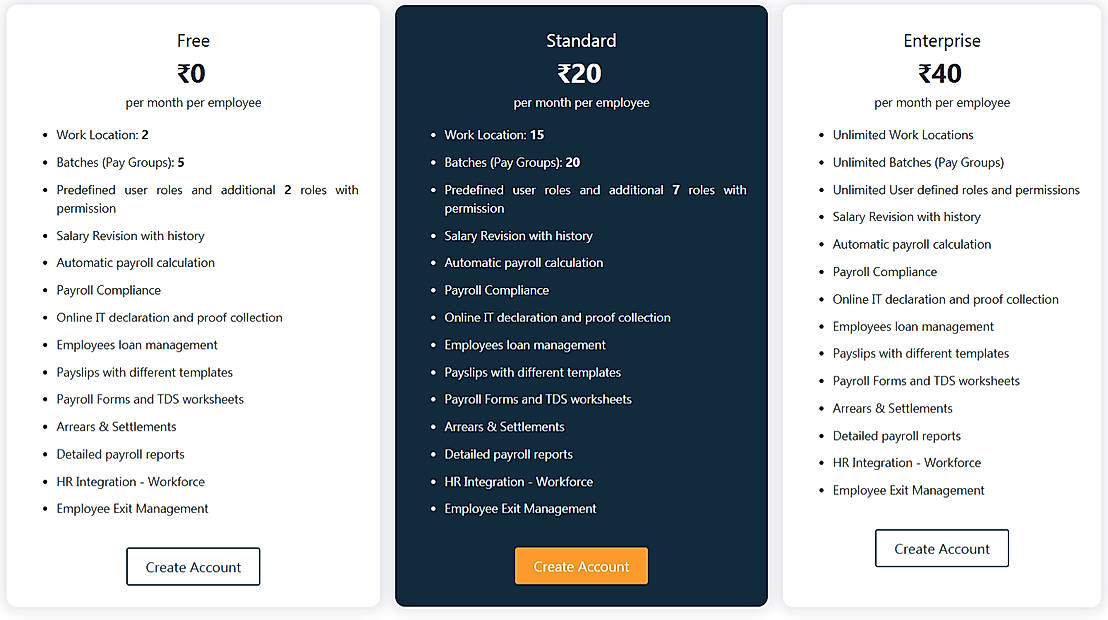

Pricing Plans

Free Free

Features

Standard Others

Features

Enterprise Others

Features

Screenshots of Vendor Pricing Page

Disclaimer: The pricing details were last updated on 20/11/2024 from the vendor website and may be different from actual. Please confirm with the vendor website before purchasing.

Learn more about Zenyo Payroll Pricing

82% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

70% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

82% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

81% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

78% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

89% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

82% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

80% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Zenyo Workforce: ...

Sign Up Training ...

What is Zenyo Payroll used for?

Zenyo Payroll is Payroll Software. Zenyo Payroll offers the following functionalities:

Learn more about Zenyo Payroll features.

What are the top alternatives for Zenyo Payroll?

Does Zenyo Payroll provide API?

No, Zenyo Payroll does not provide API.

Vendor Details

Beaverton, Oregon - 97005Social Media Handles

This research is curated from diverse authoritative sources; feel free to share your feedback at feedback@saasworthy.com

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.