Free Trial

Available

No Credit Card Required, Get Started for Free

The Average Cost of a basic Accounting Software plan is $19 per month.

Mocha Accounting pricing starts at $10/month, which is 47% lower than similar services.

44% of Accounting Software offer a Free Trial , while 17% offer a Freemium Model .

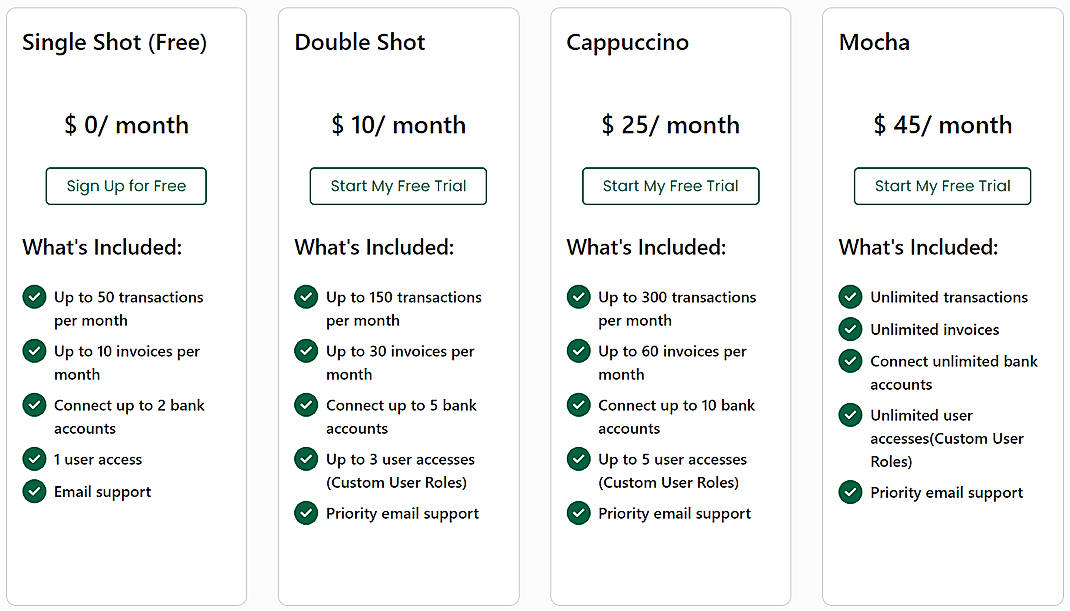

Single Shot (Free) Free

Features

Double Shot $10.00 $10.00 per month

Features

Cappuccino $25.00 $25.00 per month

Features

Mocha $45.00 $45.00 per month

Features

Screenshots of Vendor Pricing Page

Disclaimer: The pricing details were last updated on 23/09/2024 from the vendor website and may be different from actual. Please confirm with the vendor website before purchasing.

How much does Mocha Accounting cost?

The pricing for Mocha Accounting starts at $10.0 per month. Mocha Accounting has 3 different plans:

Mocha Accounting also offers a Free Plan with limited features.

Learn more about Mocha Accounting pricing.

Does Mocha Accounting offer a free plan?

Yes, Mocha Accounting offers a free plan.

Learn more about Mocha Accounting pricing.

| Product Name | Starting Price ($) | Billed | Unit | Free Trial | Learn More |

|---|---|---|---|---|---|

|

|

10 | per month | - | Mocha Accounting Pricing | |

|

|

- | - | - | QuickFile Pricing | |

|

|

7.5 | per month | - | Sage Business Cloud Accounting Pricing | |

|

|

16.58 | per month | - | AccountingSuite Pricing | |

|

|

1.02 | - | - | easybook.io Pricing | |

|

|

30 | per month | - | Quickbooks Pricing | |

|

|

- | - | - | AlignBooks Pricing | |

|

|

6.3 | per month | - | Freshbooks Pricing | |

|

|

- | - | - | autoTax Pricing | |

|

|

- | - | - | AccountsIQ Pricing |

96% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

95% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

91% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

87% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

87% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

86% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

86% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

85% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

87% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

87% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

86% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

74% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

98% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

91% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

95% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

90% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

87% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Purchasing

Acquiring goods or services required for the business at minimal costMulti-Currency

Enables payment and collection in multiple currencies.General Ledger

Maintaining and recording all the accounting related transactions.Expense Tracking

Keep a count of your day to day expenses as well as allows you to quickly identify where the expense report is in the approval process.Collections

Recovery of cash from a business or individual.Billing and Invoicing

This feature helps in issuing and handling the invoice and bills.Bank Reconciliation

Matching the balances of an entity's accounting records with the corresponding information on a bank statement.Accounts Receivable

Handling the money the client owes to the company.Accounts Payable

Handling the money owed by a business to its suppliers.Tax Management

Management of finances for payment of tax as well as assessing the advance tax liability to pay your tax in timeSpend Management

Managing the expenditure of a business in order to build its product or servicesRevenue Recognition

Determining the specific conditions under which revenue is recognized or accounted forProject Accounting

Creation of financial reports specifically designed to track the financial progress of projectsPayroll

Handling the salary payable to the employeesFixed Asset Management

Helps in tracking fixed assets for the purposes of financial accounting, preventive maintenance, and theft deterrence.CPA Firms

Offers collaboration with a professional expert for financial and consulting services.Cash Management

Collection and management of cash.

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.