Loansifter is a PPE platform that allows major brokers to look for the best execution among wholesale investors, helping them to stay competitive and safely implement lucrative lending plans. It evaluates BESTXTM product eligibility and pricing for financing situations across hundreds of investors and thousands of goods in mere seconds. With LoanSifter, you can see a comprehensive pricing grid and instructions for more than 120 wholesale investors with just one click. You can set your own search criteria settings or use a direct LOS interface with Calyx Point or Encompass to save even more time. The Loansifter PPE's features dramatically enhance process efficiency and offer you the insights to quote the best price every time. Users can also customise search defaults to fit their most typical loan circumstances, and they can even establish investor groups to search only the investors they interact with most frequently. With LoanSifter’s versatility, you can receive quotes with fewer clicks and examine results more quickly. Additionally, it also allows you to easily obtain special offers from investors you may not be aware of.

Read morePricing

SW Score Breakdown

Platforms Supported

Organization Types Supported

API Support

Modes of Support

Compliance Management

Helps in making an assessment of risks, ensures policy comprehension and that policies/procedures are being followedClient Management (Customer)

Facilitates strong necessary data about clients/customers and allows access to it when requiredCustom Workflows

Facility to create workflows with custom stages, process, and status.Free Trial

Not available

Pricing Plans

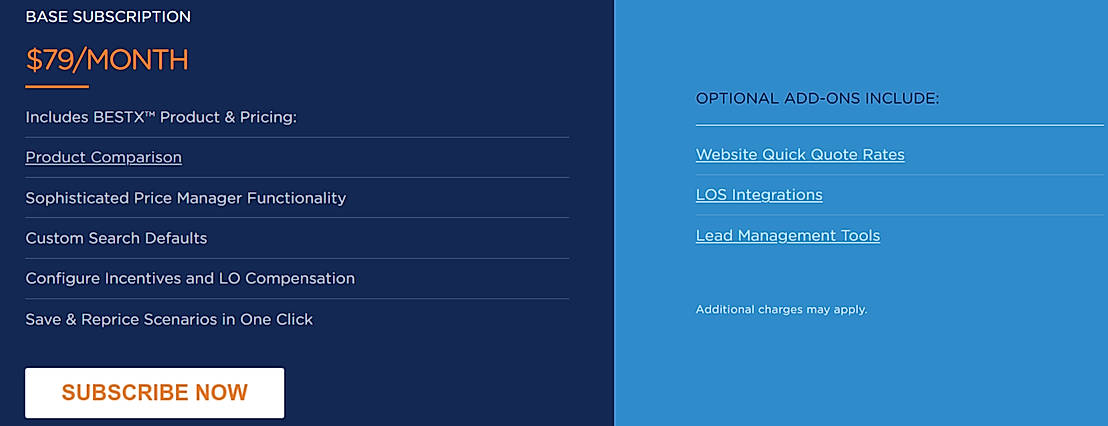

BASE SUBSCRIPTION $79.00 $79.00 per month

Features

Optional Add-ons

Screenshots of Vendor Pricing Page

Learn more about LoanSifter Pricing

80% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

84% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

82% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

94% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

86% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

81% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

79% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

88% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

78% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

What is LoanSifter used for?

LoanSifter is Loan Origination Software. LoanSifter offers the following functionalities:

Learn more about LoanSifter features.

What are the top alternatives for LoanSifter?

Does LoanSifter provide API?

No, LoanSifter does not provide API.

Vendor Details

Plano, TexasSocial Media Handles

This research is curated from diverse authoritative sources; feel free to share your feedback at feedback@saasworthy.com

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.