LendingPad is a cloud-based loan origination software that offers a complete platform for loan origination solutions for institutions, mortgage brokers, banks, service providers, and lenders. It is specially designed to streamline the lending process, minimize mortgage lending costs, and strengthen communication. This innovatively built platform is fully secured and potently optimizes the complex loan origination process designed by mortgage banking professionals. Moreover, this software allows the user's to originate loans from anywhere with a proper internet connection. Users can incorporate with third-party data providers to manage and connect with leads promptly. This tool can gather data from retail branches, consumer online portals, call centers, and in-house loan officers. The Lender edition comprises functionalities that offer secondary, closing, underwriting post-closing, and funding. Furthermore, to enhance the connectivity and operating efficiency, a range of customization features are offered for Institutions to scale the business to the next level. With processing centers, users can equip contract processing teams to cater to more clients with extensive volumes. LendingPad follows a quotation-based and subscription-based pricing strategy that includes institution edition and broker edition.

Read morePricing

SW Score Breakdown

Platforms Supported

Organization Types Supported

API Support

Modes of Support

Compliance Management

Helps in making an assessment of risks, ensures policy comprehension and that policies/procedures are being followedClient Management (Customer)

Facilitates strong necessary data about clients/customers and allows access to it when requiredCustom Workflows

Facility to create workflows with custom stages, process, and status.Free Trial

Not available

Pricing Plans

Broker Edition $55.00 $55.00 per month

Features

Lender Edition Custom

Features

Processing Edition Custom

Features

Screenshots of Vendor Pricing Page

Learn more about LendingPad Pricing

88% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

89% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

78% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

86% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

79% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

81% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

79% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

82% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

88% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

83% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

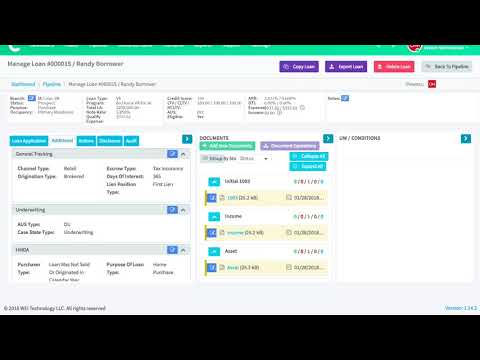

LendingPad Loan O...

How to Use Docume...

What is LendingPad used for?

LendingPad is Loan Origination Software. LendingPad offers the following functionalities:

Learn more about LendingPad features.

What are the top alternatives for LendingPad?

Here`s a list of the best alternatives for LendingPad:

Does LendingPad provide API?

Yes, LendingPad provides API.

Vendor Details

McLean, Virginia Founded : 2015Social Media Handles

This research is curated from diverse authoritative sources; feel free to share your feedback at feedback@saasworthy.com

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.