Finflux is an intuitive lending software that offers all-in-one solutions regarding loan management, loan origination, marketplace integration, financial accounting, alternative data-based credit scoring, app-based lending, dashboards & reporting, along with analytics. Loan processing agents and organizations can easily use this platform to generate more leads. They can also create customized workflows to suit their sales velocity. With Finflux, users get role-specific, pre-built templates to create onboarding workflow for their customers and let them have a speedy experience in onboarding. Features like Underwrite, make lending decisions faster and wiser. Users can create rules, monitor portfolio risks, deploy policies, and more. The software also comes equipped with risk analytics and third-party integrations, helping enterprises enrich their customer data besides making decisions in real-time. Lastly, Finflux with its wide variety of valuable highlights like Multi-channel Engagement, KYC/AML Checks, Automated Reminders, e-Receipt generation, Diverse collection options, and Predefined regulatory reporting for fine-tuning and policy-making ensures seamless business.

Read morePricing

SW Score Breakdown

Platforms Supported

Organization Types Supported

API Support

Modes of Support

Compliance Management

Helps in making an assessment of risks, ensures policy comprehension and that policies/procedures are being followedClient Management (Customer)

Facilitates strong necessary data about clients/customers and allows access to it when requiredCustom Workflows

Facility to create workflows with custom stages, process, and status.Free Trial

Not available

Pricing Plans

Finflux Custom

Features

Disclaimer: The pricing details were last updated on 01/09/2020 from the vendor website and may be different from actual. Please confirm with the vendor website before purchasing.

Learn more about Finflux Pricing

94% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

89% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

88% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

85% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

86% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

82% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

98% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

92% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

89% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

83% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

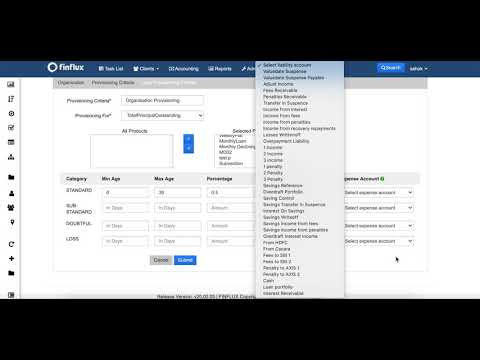

Screen Recording ...

What is Finflux used for?

Finflux is Loan Origination Software. Finflux offers the following functionalities:

Learn more about Finflux features.

What are the top alternatives for Finflux?

Here`s a list of the best alternatives for Finflux:

Does Finflux provide API?

Yes, Finflux provides API.

Vendor Details

Bengaluru, IndiaSocial Media Handles

This research is curated from diverse authoritative sources; feel free to share your feedback at feedback@saasworthy.com

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.