|

|

87% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Visit Website

|

94% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Visit Website

|

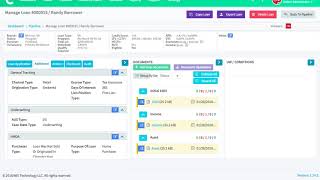

| Description | Loansifter is a PPE platform that allows major brokers to look for the best execution among wholesale investors, helping them to stay competitive and safely implement lucrative lending plans. It evaluates BESTXTM product eligibility and pricing for financing situations across hundreds of investors and thousands of goods in mere seconds. With LoanSifter, you can see a comprehensive pricing grid and instructions for more than 120 wholesale investors with just one click. You can set your own search criteria settings or use a direct LOS interface with Calyx Point or Encompass to save even more time. The Loansifter PPE's features dramatically enhance process efficiency and offer you the insights to quote the best price every time. Users can also customise search defaults to fit their most typical loan circumstances, and they can even establish investor groups to search only the investors they interact with most frequently. With LoanSifter’s versatility, you can receive quotes with fewer clicks and examine results more quickly. Additionally, it also allows you to easily obtain special offers from investors you may not be aware of. Read more | LendingPad is a cloud-based loan origination software that offers a complete platform for loan origination solutions for institutions, mortgage brokers, banks, service providers, and lenders. It is specially designed to streamline the lending process, minimize mortgage lending costs, and strengthen communication. This innovatively built platform is fully secured and potently optimizes the complex loan origination process designed by mortgage banking professionals. Moreover, this software allows the user's to originate loans from anywhere with a proper internet connection. Users can incorporate with third-party data providers to manage and connect with leads promptly. This tool can gather data from retail branches, consumer online portals, call centers, and in-house loan officers. The Lender edition comprises functionalities that offer secondary, closing, underwriting post-closing, and funding. Furthermore, to enhance the connectivity and operating efficiency, a range of customization features are offered for Institutions to scale the business to the next level. With processing centers, users can equip contract processing teams to cater to more clients with extensive volumes. LendingPad follows a quotation-based and subscription-based pricing strategy that includes institution edition and broker edition. Read more |

| Pricing Options |

|

|

| SW Score & Breakdown |

87% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

94% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

| Total Features |

4 Features

|

7 Features

|

| Common Features for All |

Audit Trail

Chat (Messaging)

Client Management (Customer)

Compliance Management

Document Management

Workflow Management

e-Signature

|

Audit Trail

Chat (Messaging)

Client Management (Customer)

Compliance Management

Document Management

Workflow Management

e-Signature

|

| Organization Types Supported |

|

|

| Platforms Supported |

|

|

| Modes of Support |

|

|

| API Support |

|

|

| User Rating |

|

|

| Rating Distribution |

|

|

| User Sentiments |

Not Available

|

User-Friendly Interface, Efficient Customer Support, Comprehensive Loan Origination System, Seamless Integrations Occasional System Slowness, Limited Loan Program Options, Occasional Glitches/Errors, Lack of Cumulative Amortization Schedule |

| Review Summary |

Not Available

|

User reviews of LendingPad highlight its user-friendly interface, fast processing, and excellent customer support. Users appreciate its intuitive design, making it easy to navigate and complete tasks quickly. The platform’s web-based nature and seamless integration with other systems are also commended. However, some users mention occasional lag or slow loading times, and a few express concerns about limited customization options and a lack of integration with certain third-party services. Overall, the reviews suggest LendingPad is a valuable tool for mortgage brokers and lenders, offering a streamlined and efficient loan origination process. |

| Read All User Reviews | Read All User Reviews |

AI-Generated from the text of User Reviews

| Pricing Options |

|

|

|

Pricing Plans

Monthly Plans

Annual Plans

|

BASE SUBSCRIPTION $79.00 $79.00 per month |

Broker Edition $55.00 $55.00 per month Lender Edition Custom Processing Edition Custom |

|

View Detailed Pricing

|

View Detailed Pricing

|

| Videos | Not Available |

+ 1 More

|

| Company Details | Located in: Plano, Texas | Located in: McLean, Virginia Founded in: 2015 |

| Contact Details |

844-465-1001 |

+1 202-796-2790 |

| Social Media Handles |

|

|

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.