Pay people in under a minute with Roll, the groundbreaking chat-based payroll app for small businesses. Backed by ADP, the largest payroll company in the US, Roll by ADP makes payroll a breeze. Imagine having the expertise and reliability of the biggest name in payroll right in the pocket. Roll handles everything for turning complex payroll tasks into a seamless, user-friendly experience. Whether at the office or on the go, this app lets to manage payroll with just a few taps in a chat interface. No more headaches, no more fuss—just efficient, accurate payroll processing that fits into the busy schedule. It's the perfect solution for small business owners who need a reliable partner to handle payroll so they can focus on growing their business. Feel the ease and power of having ADP’s decades of expertise available anytime, anywhere. Try Roll by ADP and revolutionize the way manage the payroll today.

Read morePricing

SW Score Breakdown

Platforms Supported

Organization Types Supported

API Support

Modes of Support

Unique Features

401(k) Tracking

Helps to track and manage matters concerning 401(k) that is a retirement savings plan sponsored by an employer.Tax Management

Management of finances for payment of tax as well as assessing the advance tax liability to pay your tax in timeMulti-country

Supports electronically transfer of payments to employees regardless of the country or stateStandard Features

Tax Filing

Allows the filing of payroll tax forms for federal, state, and local taxes.Wage Garnishment

Helps in deducting the amount from an employee's monetary compensation including salary as per a court order to pay off debtW-2 Preparation

Helps electronically preparing the W-2 form that reveals the total gross income of an employee.Self Service Portal

Provides the employees with a website where they can update their accounts, make bill payments, avail necessary information and other self-help functionsDirect Deposit

Supports direct deposit which is the most popular method for giving paycheques to employees in an electronic formDeductions Management

Helps optimizing deductions workflow and assist in calculating various deductions or additions like ESI, PF, integrating leave, performanceCompensation Management

Manages employee compensation related data in an organized and automated mannerCheck Printing

Allows previewing and printing standard and customized paychecksBenefits Management

Helps in monitoring and managing non-wage compensation given to employees besides their regular salaries or wages.PEO Services

Professional Employer Organizations (PEOs) offer small and medium-sized businesses affordable HR services and benefits by serving as co-employers and managing compliance, eliminating the need for an in-house HR department.EOR Services

Facilitates the management of employment-related responsibilities, compliance, and HR functions associated with Employer of Record (EOR) servicesLeave Tracking (Vacation)

Assist in keeping track of leave and holidays for easing the payment calculation processAttendance Tracking

Helps to quickly and easily track the attendanceMulti-Currency

Enables payment and collection in multiple currencies.Free Trial

Available

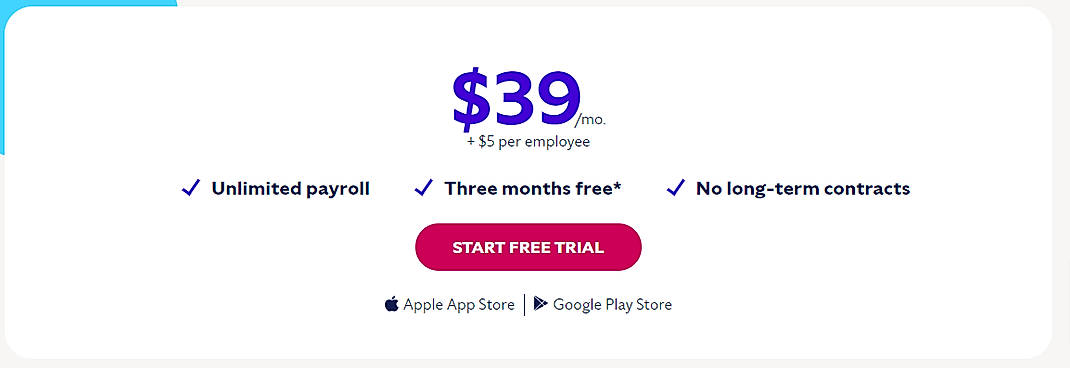

Roll by ADP $39.00 $39.00 per month

$39 per Month + $5 per employee

Features

Screenshots of Vendor Pricing Page

Learn more about Roll by ADP Pricing

89% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Featured

85% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

79% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

76% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

82% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

87% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

89% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

81% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

79% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

81% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Say hello to Roll...

Roll by ADP - App...

Run Payroll in Un...

What is Roll by ADP used for?

Roll by ADP is Payroll Software. Roll by ADP offers the following functionalities:

Learn more about Roll by ADP features.

What are the top alternatives for Roll by ADP?

Does Roll by ADP provide API?

No, Roll by ADP does not provide API.

Vendor Details

Roseland, New JerseySocial Media Handles

This research is curated from diverse authoritative sources; feel free to share your feedback at feedback@saasworthy.com

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.