Anrok automates the entire process of sales tax compliance, making it easier for SaaS businesses to scale quickly and efficiently. They synchronize financial platform to track the nexus of remote hiring and sales, and accurately match products and services to their respective tax categories. They take away the burden of monitoring and calculation, and handle all registration, filing, and payment for user. As a result, can rest assured that sales tax compliance is taken care of, and business can grow in any market without worrying about tax-related complications.

Read morePricing

SW Score Breakdown

Platforms Supported

Organization Types Supported

API Support

Modes of Support

Tax Management

Management of finances for payment of tax as well as assessing the advance tax liability to pay your tax in timeRevenue Recognition

Determining the specific conditions under which revenue is recognized or accounted forExpense Tracking

Keep a count of your day to day expenses as well as allows you to quickly identify where the expense report is in the approval process.Collections

Recovery of cash from a business or individual.Billing and Invoicing

This feature helps in issuing and handling the invoice and bills.Spend Management

Managing the expenditure of a business in order to build its product or servicesPurchasing

Acquiring goods or services required for the business at minimal costProject Accounting

Creation of financial reports specifically designed to track the financial progress of projectsPayroll

Handling the salary payable to the employeesMulti-Currency

Enables payment and collection in multiple currencies.General Ledger

Maintaining and recording all the accounting related transactions.Fixed Asset Management

Helps in tracking fixed assets for the purposes of financial accounting, preventive maintenance, and theft deterrence.CPA Firms

Offers collaboration with a professional expert for financial and consulting services.Cash Management

Collection and management of cash.Bank Reconciliation

Matching the balances of an entity's accounting records with the corresponding information on a bank statement.Accounts Receivable

Handling the money the client owes to the company.Accounts Payable

Handling the money owed by a business to its suppliers.Free Trial

Not available

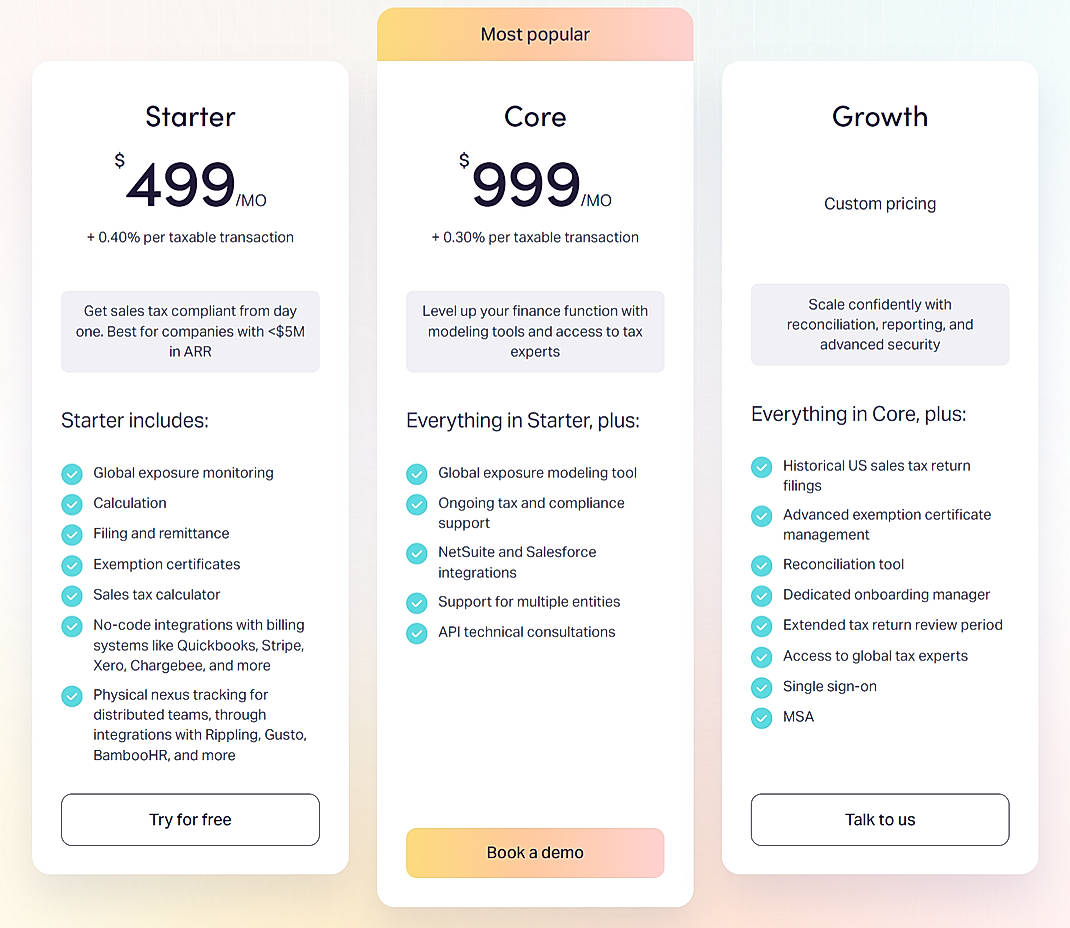

Starter $499.00 $499.00 per month

Get Sales Tax Compliant From Day One. Best for Companies With <$5M in ARR.

+ 0.40% Per Taxable Transaction

Features

Core $999.00 $999.00 per month

Level up your Finance Function with Modeling Tools and Access to Tax Experts.

+ 0.30% Per Taxable Transaction

Features

Growth Custom

Scale Confidently with Reconciliation, Reporting, and Advanced Security.

Features

Screenshots of Vendor Pricing Page

Learn more about Anrok Pricing

90% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

87% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

What is Anrok used for?

Anrok is Accounting Software. Anrok offers the following functionalities:

Learn more about Anrok features.

What are the top alternatives for Anrok?

Here`s a list of the best alternatives for Anrok:

Does Anrok provide API?

No, Anrok does not provide API.

Vendor Details

San Francisco, CaliforniaSocial Media Handles

This research is curated from diverse authoritative sources; feel free to share your feedback at feedback@saasworthy.com

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.