|

|

82% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Get Free Advice

|

83% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Get Free Advice

|

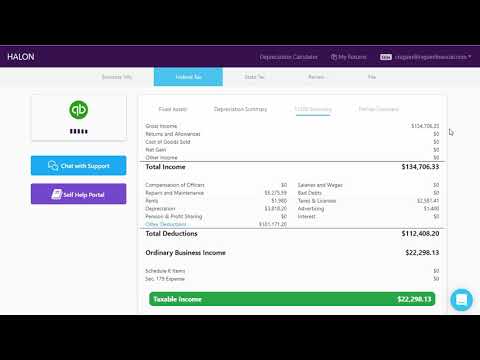

| Description | Halon Tax offers multiple accounting & tax services including tax returns, bookkeeping review & more. The focus of the services is to minimize tax for which both business and personal returns are analyzed for deductions. Users can also connect with one of its in-house CPA's to ask questions, review returns, and for any clarifications on tax options and the strategies recommended. It's team reviews user books and looks for missing deductions and then works with users to get everything ready for tax time. Users can also rely on Halon Tax to prepare returns such as Form 1120S, Form 1065 and Form 1040. Users can receive K-1's, state tax returns, and any other form the IRS requires and once the return is finished, it can be stored in Halon's secure servers for up to 7 years. The returns can also be e-filed, and direct bank account deposit of the returns can also be ensured. Read more | KhataBook is an intuitive digital ledger app that helps micro, small and medium merchants to track and record their business transactions safely. It also allows users to send and receive online payments through UPI and QR code. Moreover, the app generated reports can be downloaded and shared by the users, with every transaction to maintain a proper schedule of debits and credits easily. It conducts automatic data backups, facilitating accurate protection against phone theft or loss. Khatabook automatically syncs all of the data, saving hours of users’ time. With the KhataBook QR, users can receive payments from any other app. They can send automatic payment reminders along with the payment links to customers and receive timely payments. The app provides 24x7 support available in 12 languages for any generated queries. More than 4 crore+ businesses have been registered for this app in 4000+ cities across India. Read more |

| Pricing Options |

|

|

| SW Score & Breakdown |

82% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

83% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

| SaaSworthy Awards |

Not Available

|

# 4 Fastest Growing # 5 Most Popular |

| Total Features |

12 Features

|

13 Features

|

| Common Features for All |

Accounts Payable

Accounts Receivable

Bank Reconciliation

Billing and Invoicing

Budget Forecasting

CPA Firms

Cash Management

Collections

Expense Tracking

General Ledger

Payroll

Purchasing

Revenue Recognition

Spend Management

Tax Management

|

Accounts Payable

Accounts Receivable

Bank Reconciliation

Billing and Invoicing

Budget Forecasting

CPA Firms

Cash Management

Collections

Expense Tracking

General Ledger

Payroll

Purchasing

Revenue Recognition

Spend Management

Tax Management

|

| Organization Types Supported |

|

|

| Platforms Supported |

|

|

| Modes of Support |

|

|

| User Rating |

|

|

| Rating Distribution |

|

|

| User Sentiments |

Responsive Customer Support, Knowledgeable Staff, Easy-to-Use Platform, Timely Communication Inconsistent Service Quality, Lack of Tax Planning Guidance, Poor Communication Regarding Changes, Inadequate Handling of Tax Filing |

Not Available

|

| Review Summary |

Based on Trustpilot reviews, Halontax is generally praised for its user-friendly interface, ease of use, and helpful customer support. Many users appreciate the platform's clear and concise explanations of tax laws and regulations, as well as its comprehensive range of features for tax preparation and filing. However, some users have reported occasional technical glitches and delays in customer service response times. Overall, Halontax seems to be a well-received tax software with positive feedback from a majority of its users. |

Not Available

|

| Read All User Reviews | Read All User Reviews |

AI-Generated from the text of User Reviews

| Pricing Options |

|

|

|

Pricing Plans

Monthly Plans

Annual Plans

|

Corporate Tax Return $699.00 $699.00 per year Corporate & Personal Tax Return $999.00 $999.00 per year Tax Projections & Strategies $489.00 $489.00 per year Fractional CFO Module $1,899.00 $1,899.00 per year |

KhataBook Free |

|

View Detailed Pricing

|

View Detailed Pricing

|

| Screenshots |

+ 5 More

|

Not Available |

| Videos |

|

|

| Company Details | Located in: Eden Prairie, MN - 55344 Founded in: 2016 | Located in: Bangalore, India - 560102 Founded in: 2018 |

| Contact Details |

612.293.8094 |

+91-9606800800 |

| Social Media Handles |

|

|

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.