|

|

82% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Get Free Advice

|

86% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Get Free Advice

|

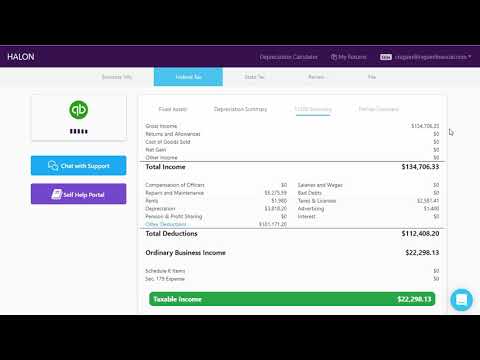

| Description | Halon Tax offers multiple accounting & tax services including tax returns, bookkeeping review & more. The focus of the services is to minimize tax for which both business and personal returns are analyzed for deductions. Users can also connect with one of its in-house CPA's to ask questions, review returns, and for any clarifications on tax options and the strategies recommended. It's team reviews user books and looks for missing deductions and then works with users to get everything ready for tax time. Users can also rely on Halon Tax to prepare returns such as Form 1120S, Form 1065 and Form 1040. Users can receive K-1's, state tax returns, and any other form the IRS requires and once the return is finished, it can be stored in Halon's secure servers for up to 7 years. The returns can also be e-filed, and direct bank account deposit of the returns can also be ensured. Read more | Certify is a cloud-based travel and expense management solution for organizations of all sizes, and is the only solution in the expense management industry to offer truly automated expense reporting. With prescheduled, auto-generated expense report creation and mobile capabilities, Certify eliminates the need for paper receipts and spreadsheets, and provides insight into travel and expense spend with a full suite of on-demand reporting and analytics. Read more |

| Pricing Options |

|

|

| SW Score & Breakdown |

82% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

86% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

| Total Features |

12 Features

|

9 Features

|

| Common Features for All |

Accounts Payable

Accounts Receivable

Bank Reconciliation

Billing and Invoicing

CPA Firms

Cash Management

Collections

Expense Tracking

General Ledger

Multi-Currency

Payroll

Project Accounting

Revenue Recognition

Spend Management

Tax Management

|

Accounts Payable

Accounts Receivable

Bank Reconciliation

Billing and Invoicing

CPA Firms

Cash Management

Collections

Expense Tracking

General Ledger

Multi-Currency

Payroll

Project Accounting

Revenue Recognition

Spend Management

Tax Management

|

| Organization Types Supported |

|

|

| Platforms Supported |

|

|

| Modes of Support |

|

|

| User Rating |

|

|

| Rating Distribution |

|

|

| User Sentiments |

Responsive Customer Support, Knowledgeable Staff, Easy-to-Use Platform, Timely Communication Inconsistent Service Quality, Lack of Tax Planning Guidance, Poor Communication Regarding Changes, Inadequate Handling of Tax Filing |

Mobile Receipt Capture, Easy Expense Report Creation, Automated Credit Card Integration, Fast Reimbursements Inaccurate Autofill, Receipt Syncing Issues, Mobile App Instability, Cumbersome Expense Editing |

| Review Summary |

Based on Trustpilot reviews, Halontax is generally praised for its user-friendly interface, ease of use, and helpful customer support. Many users appreciate the platform's clear and concise explanations of tax laws and regulations, as well as its comprehensive range of features for tax preparation and filing. However, some users have reported occasional technical glitches and delays in customer service response times. Overall, Halontax seems to be a well-received tax software with positive feedback from a majority of its users. |

Overall, Certify is a well-received travel and expense management solution praised for its user-friendly interface, robust features, and efficient expense reporting capabilities. Many users highlight its seamless integration with various accounting systems and credit cards, enabling effortless expense tracking and reimbursement. However, some users have reported occasional glitches and technical issues, and a few have expressed concerns regarding the pricing structure. Nevertheless, Certify's strengths in usability, functionality, and customer support make it a popular choice among businesses seeking a reliable and comprehensive expense management solution. |

| Read All User Reviews | Read All User Reviews |

AI-Generated from the text of User Reviews

| Pricing Options |

|

|

|

Pricing Plans

Monthly Plans

Annual Plans

|

Corporate Tax Return $699.00 $699.00 per year Corporate & Personal Tax Return $999.00 $999.00 per year Tax Projections & Strategies $489.00 $489.00 per year Fractional CFO Module $1,899.00 $1,899.00 per year |

Certify Now $8.00 $8.00 per user / month Professional Custom Enterprise Custom |

|

View Detailed Pricing

|

View Detailed Pricing

|

| Screenshots |

+ 5 More

|

+ 4 More

|

| Videos |

|

+ 2 More

|

| Company Details | Located in: Eden Prairie, MN - 55344 Founded in: 2016 | Located in: Maine, United States |

| Contact Details |

612.293.8094 |

207-773-6100 |

| Social Media Handles |

|

|

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.