|

|

81% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Visit Website

|

80% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Visit Website

|

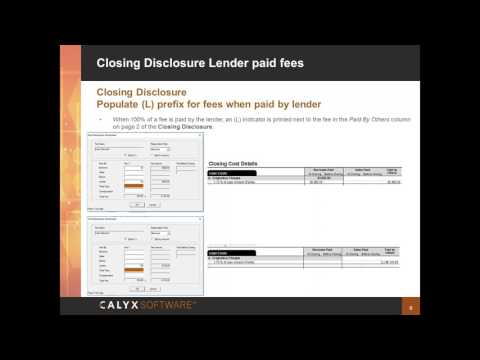

| Description | Calyx Point as an efficient loan origination software allows mortgage brokers and agents to get their loans processed in real-time, from application till closing. The software makes users aware of the fees they need to pay without any hidden charges, enabling them to keep the overall costs in check. With the in-built templates, the platform also ensures consistency in standardizing loan programs, borrower files, closing costs, etc. It helps users to save their valuable effort and time besides closing more deals, by allowing them to create, capture and save pre-application data for existing prospective borrowers. Mortgage brokers also get to build strong relationships with their borrowers, through different marketing tools, including loan comparisons, open house flyers, and pre-approval letters. Organisations using Calyx Point, also get access to a host of services like asset verification, credit reporting, product pricing, eligibility checking, compliance services, etc. Moreover, users can receive advice from mortgage specialists through the platform and increase their efficiency levels in a whole. Read more | AllCloud is a modern lending infrastructure that is used to fuel the future of financial services. It offers a pre-built system that automates data management and reporting for companies. AllCloud fulfils all the administration requirements to scale up the operations at lower costs. It also provides an omnichannel loan management solution that caters to the large volume of one’s business, ensuring efficiency, transparency and accuracy across all stages. AllCloud is a completely flexible and customised solution that would be configured to fulfil existing operational protocols for multiple channels, products and processes alike. Its easy-to-integrate feature makes the transactional process seamless. AllCloud’s automated underwriting services help users to augment the process of judging the creditworthiness of the applicant before issuing a loan. Furthermore, its AI-backed risk and scoring abilities reduce NPAs. The software even keeps up with the dynamic industry trends and regulatory norms with its highly robust loan origination. Its other solutions include debt recovery, analytics & reporting. Read more |

| Pricing Options |

|

|

| SW Score & Breakdown |

81% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

80% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

| Total Features |

2 Features

|

2 Features

|

| Common Features for All |

Audit Trail

Document Management

Workflow Management

|

Audit Trail

Document Management

Workflow Management

|

| Organization Types Supported |

|

|

| Platforms Supported |

|

|

| Modes of Support |

|

|

| User Rating |

|

|

| Rating Distribution |

|

|

| Read All User Reviews | Read All User Reviews |

AI-Generated from the text of User Reviews

| Pricing Options |

|

|

|

Pricing Plans

Monthly Plans

Annual Plans

|

Calyx Point Custom |

AllCloud Custom |

|

View Detailed Pricing

|

View Detailed Pricing

|

| Videos |

+ 1 More

|

Not Available |

| Company Details | Located in: Dallas, Texas | Located in: Hyderabad, India |

| Contact Details |

(800) 342-2599 |

+91-7229867770 |

| Social Media Handles |

Not available |

|

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.