Zil Money allows to pay employees on time and earn cash back rewards using the Payroll by Credit Card feature. Users can also write-off payroll funding by credit card fees as a business expense. Improve cash flow and employee satisfaction with this flexible solution. The cloud-based platform offers various features to improve online financial operations. Move money seamlessly with payment options like ACH, wire transfers, eChecks, printable checks, and more. Users can also customize and print checks instantly on blank stock papers using a regular printer at the office or home. Zil Money is a financial technology company, not a bank or an FDIC member. Zil Money partners with FDIC member banks Silicon Valley Bank and Texas National Bank to offer banking services.

Read morePricing

Platforms Supported

Organization Types Supported

API Support

Modes of Support

Free Trial

Available

Pricing Plans

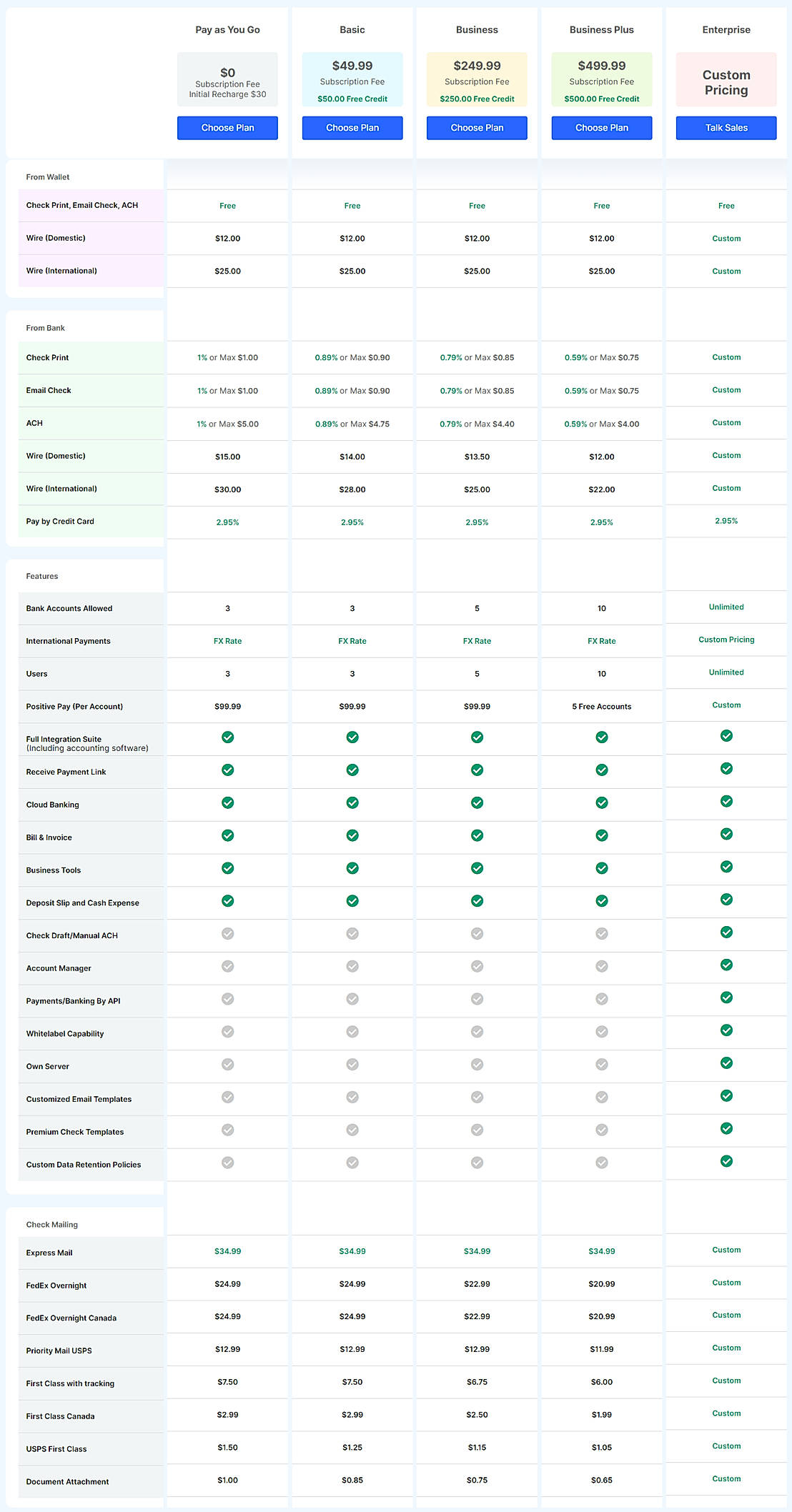

Pay as You Go Others

Initial Recharge $30

Features

Basic $49.99 $49.99 per month

$50.00 Free Credit

Features

Business $249.99 $249.99 per month

$250 Free Credit

Features

Business Plus $499.99 $499.99 per month

$500 Free Credit

Features

Enterprise Custom

Features

Screenshots of Vendor Pricing Page

Learn more about Zil Money Pricing

What is Zil Money?

Zil Money Introdu...

What are the top alternatives for Zil Money?

Does Zil Money provide API?

Yes, Zil Money provides API.

Vendor Details

San Jose, California - 95113Social Media Handles

This research is curated from diverse authoritative sources; feel free to share your feedback at feedback@saasworthy.com

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.