PayDo, a UK-regulated Electronic Money Institution offering global payment solutions for businesses—ranging from multicurrency IBANs and mass payouts to virtual and physical cards. PayDo, which operates in more than 25 industries and more than 150 countries, provides a single platform for users to open multicurrency IBAN accounts, issue virtual and physical Visa cards, and access a comprehensive suite of merchant tools. Whether it’s sending international transfers, accepting customer payments, or managing expenses, everything is handled from one dashboard. PayDo is unique in that it offers safe and adaptable solutions that are customised to meet the needs of each client, supporting both high-risk and mainstream industries like e-commerce, digital services, and iGaming.

Read morePricing

SW Score Breakdown

Platforms Supported

Organization Types Supported

API Support

Modes of Support

Invoice Payment

Enables merchants to accept payments through custom links by creating invoicesPoS Transactions

Enables merchants to accept payment on Point of SaleMultiple Currency Processing

Enables merchants to accept payment in multiple currenciesWebsite Payments

Enables merchants to accept payment on websitesSaved Cards

Offers saving credentials of debit and credit cards for faster payment checkout in futureRecurring Billing

Enables merchants to charge from customers on a recurring (periodic) basisGift Card Management

Manages prepaid payment card processing that helps the cardholder purchase goods online or within a specific retail storeFree Trial

Available

Pricing Plans

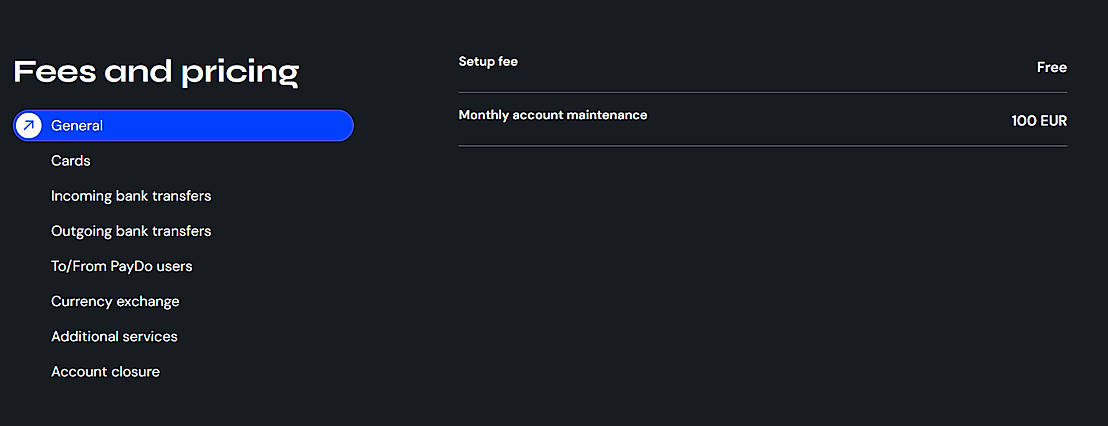

Pricing Business account Others

Monthly account maintenance: EUR 100

Setup fee: Free

Features

Based upon the Cards, Incoming bank transfers, Outgoing bank transfers, To/From PayDo users, Currency exchange, Additional services, Account closure, and Industry and the pricing varies.

Pricing for Checkout transactions Others

Cards through PayDo wallet: 0.3 EUR + 2.9%

PayDo Wallet (EWallet): 0.2 EUR + 1.9%

Features

Screenshots of Vendor Pricing Page

Learn more about PayDo Pricing

98% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

95% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

93% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

92% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

92% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

88% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

88% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

88% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Merchant Services...

Mass Payments

Vendor Details

London, United Kingdom - E1 8FA Founded : 2017Social Media Handles

This research is curated from diverse authoritative sources; feel free to share your feedback at feedback@saasworthy.com

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.