|

|

86% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

View Details

|

84% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

View Details

|

| Description | Moneydance is a personal finance management software that helps individuals with money management, bill payment and investment tracking facilities. People can use Moneydance to manage their preferred currencies with ease. The software automatically downloads transactions and makes online bill payments in a hassle-free manner. It also categorises the transactions and removes the ones that are not important. Users can access information related to account balances, upcoming and overdue transactions and exchange rates as per convenience. The software includes various graphing tools that can generate visual reports of income and expenses. These visual reports can also be saved into PNG files and can be printed on paper. Moneydance gets a notebook like user interface, but here the calculations get done automatically. Users can create a schedule for future or periodical payments and the software will send automated reminders from time to time. Moneydance also works well to record information related to investments in stocks, bonds, CDs, mutual funds and more. Read more | MoneyWiz is a powerful personal finance tool that helps the user keep track of their finances. It offers direct sync with more than 20,000 banks across 50 countries. MoneyWiz also works with Plaid, Yodlee, and SaltEdge as an added advantage. Its features include compact layout, easy swipe across categories, bulk edit and delete, intuitive display, smart analytics on credit utilization, and balance available. The tool offers users customizations in terms of colors and logos for each category. MoneyWiz allows users to easily modify the existing shareholding to adapt to any share split or even bonus allotments. Users can keep track of their daily and monthly spends across various categories like Fuel, Groceries, utility payments, etc. Users can also set up reminders for payments and card bills. Moneywise gives a comprehensive view of all the Banks, Credit cards, Investments, Expenditures, Wallet balances, Loans, and Receivables of the user. The tool also enables users to set up budgets and goals to meet personal finance goals. Read more |

| Pricing Options |

|

|

| SW Score & Breakdown |

86% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

84% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

| Total Features |

11 Features

|

13 Features

|

| Common Features for All |

Alerts

Bills Management

Budgeting

Expense Groups

Financial Dashboard

Investment Monitoring

Loan Management

Multi-Currency

Payment Gateway

Reports

Spend Tracker

Spending Limit

Tax Reports

Transaction History

|

Alerts

Bills Management

Budgeting

Expense Groups

Financial Dashboard

Investment Monitoring

Loan Management

Multi-Currency

Payment Gateway

Reports

Spend Tracker

Spending Limit

Tax Reports

Transaction History

|

| Organization Types Supported |

|

|

| Platforms Supported |

|

|

| Modes of Support |

|

|

| API Support |

|

|

| User Rating |

|

Not Available

|

| Rating Distribution |

|

Not Available

|

| Pros & Cons |

|

|

| Read All User Reviews |

AI-Generated from the text of User Reviews

| Pricing Options |

|

|

|

Pricing Plans

Monthly Plans

Annual Plans

|

Moneydance $49.99 $49.99 One Time Payment |

Premium $4.17 $4.99 per month Standard $19.99 $19.99 per year MoneyWiz 3 (Pay once) Others MoneyWiz 3 (subscriber) Others |

|

View Detailed Pricing

|

View Detailed Pricing

|

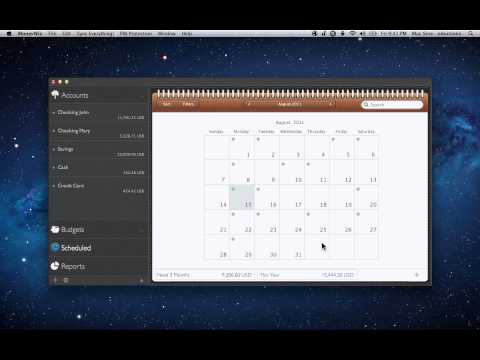

| Screenshots |

+ 2 More

|

+ 1 More

|

| Videos | Not Available |

+ 2 More

|

| Company Details | Located in: Edinburgh, Scotland | Located in: San Francisco, California |

| Contact Details |

Not available |

Not available |

| Social Media Handles |

|

|

What are the key differences between Moneydance and MoneyWiz?

What are the alternative products to Moneydance?

Which product is better for managing investments?

Can I set up reminders for payments and bills in MoneyWiz?

Which product offers more customization options?

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.